Why Car Dealers Are Walking Away From AutoTrader

For more than ten years, AutoTrader has been the backbone of digital retailing for the UK motor trade.

It has the traffic, the visibility and the brand recognition that many dealers believed couldn’t be found anywhere else. That belief shaped the behaviour of the entire industry. Dealers tolerated rising prices, rigid systems and limited negotiating power because the platform delivered enquiries and stock turn.

That long-standing relationship has started to fracture. Hundreds of dealers have cancelled or downgraded their packages. Others have joined coordinated protests. Many more are publicly questioning whether AutoTrader is still aligned with the interests of the people who actually sell the vehicles. Even dealers who continue to use the platform are increasingly planning for a future where they’re not dependent on it.

The frustration didn’t appear overnight. It has been building for years. Recent changes simply turned simmering discontent into open opposition.

What follows is a detailed breakdown of why dealers are turning away, what the shift means for the wider industry and how dealers can build sustainable marketing pipelines that give them control again.

Why confidence broke down

Dealers are practical, commercially minded to their core and focused on outcomes. When you speak to them, the frustration is rarely emotional. It’s operational. It’s financial. It’s about control. For many, AutoTrader has crossed a line by introducing changes that disrupt the sales process rather than support it.

Deal Builder forced a buying journey that didn’t reflect how dealers sell cars

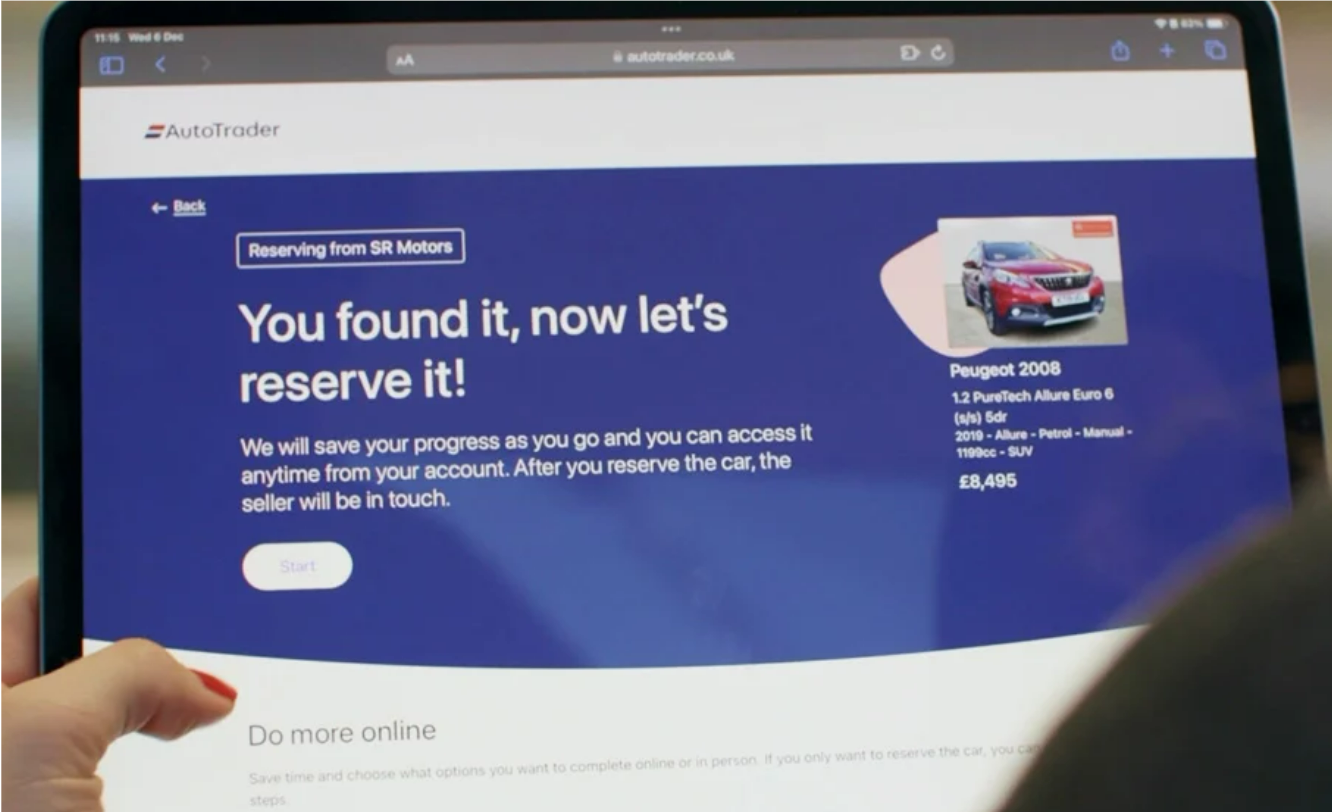

Image Credit: AutoTrader Insight

Deal Builder arrived not as an optional enhancement, but as a compulsory part of how buyers interacted with adverts. Customers were pushed into a reservation and account creation flow that neither suited all dealers nor supported every buying behaviour. It added friction at a point where speed matters most.

A reservation fee of £99 looks attractive in theory, but in practice it introduced a problem many dealers predicted immediately. It’s low enough for customers to reserve impulsively, then reconsider later. Stock becomes tied up without commitment, and genuine buyers can miss out while the dealership waits for someone who may never answer the phone.

Dealers aren’t opposed to reservations. They’re opposed to being required to use a rigid process that they didn’t design, that doesn’t reflect how they qualify enquiries and that undermines their control over the sale.

Mandatory verified accounts created an unnecessary barrier to enquiries

AutoTrader’s decision to require customers to create and verify an account just to send an enquiry is one of the most counterproductive lead-generation decisions the platform has made. If a buyer has to leave the advert, find their inbox, verify an email, return to the listing and then complete the message, a significant proportion won’t come back.

In most digital environments, adding verification to a contact form would be unthinkable. In automotive retail, where a buyer can abandon a lead instantly and find the same model from five other dealers, it’s even more damaging.

Dealers know this instinctively, which is why the reaction to the change was so strong. Anything that slows buyers down is bad for business.

Price increases have outpaced perceived value

Dealers have accepted annual price rises for years, often without complaint, because the platform delivered results. Recently, the gap between cost and perceived value has widened dramatically. Some dealers now pay several thousand pounds a month while seeing no meaningful improvement in support, capability or commercial alignment.

In a market where preparation costs are rising, consumer confidence fluctuates and stocking the right vehicles has become more expensive, tolerance for subscription increases has evaporated. Dealers aren’t saying AutoTrader has no value, they’re saying the value no longer justifies the cost for every business model.

Price markers misrepresent the value of well-prepared stock

AutoTrader’s price indicators are a constant point of tension. The system relies on large volumes of data and doesn’t consider nuance or preparation quality. Dealerships that invest heavily in cosmetic and mechanical work, extended warranties, new tyres, full service histories and stronger aftersales support often find their vehicles marked “High Price” simply because a cheaper, lower-quality example exists elsewhere.

This distorts customer expectations and forces a defensive conversation before the enquiry has even begun. Fewer dealers are willing to accept that dynamic unchallenged.

Dealers feel AutoTrader has stopped listening

This is the core issue running beneath everything else. Dealers no longer feel like partners. They feel like captive customers whose commercial needs carry less weight than the platform’s strategic direction.

Forums, trade groups, WhatsApp chats and Substack threads make the pattern clear. Dealers don’t believe they’re being consulted. They don’t believe their concerns shape the roadmap. They do believe major changes are made without meaningful consideration for the impact on real sales teams.

AutoTrader’s leadership has apologised and made some adjustments, but the apology didn’t address the underlying belief that decisions were made in a vacuum. Once trust erodes, it’s very difficult to regain.

Nathan Coe, Chief Executive Officer, AutoTrader.

Why this moment matters for the industry

For the first time in years, dealers are rethinking their relationship with the platform. They’ve realised that depending on a single source of enquiries puts them at significant commercial risk. It leaves them exposed to unilateral rule changes, rising costs and buying journeys that don’t reflect the way real dealers operate.

Dealers across the UK are now waking up to the idea that they can build stronger, safer and more profitable systems by spreading their marketing across multiple channels rather than relying on one giant. This represents a fundamental shift in the mindset of the motor trade. Dealers are demanding more control, more balance and more choice. That will shape how retailing works over the next decade.

Where dealers go once they step back from Auto Trader

Dealers who reduce their reliance on Auto Trader aren’t looking for a perfect substitute. They’re building broader ecosystems that produce consistent lead flow without giving up control of the customer journey.

The strongest strategies tend to build around the following pillars:

High-intent search through well-structured Google Ads that target specific makes and models.

Local discovery and reach through Facebook and Instagram, supported by strong creative.

Websites that are built to convert, not simply display stock.

Organic visibility from technical SEO and content that answers buyer questions.

Consistent return business from email, SMS and CRM workflows that reactivate previous customers.

Dealers who invest in these areas usually see higher-quality enquiries, more predictable sales cycles and healthier margins.

How Agilita Digital can help dealers take control

Agilita Digital works with dealerships that want a stronger, more balanced marketing engine that they control, not one that depends on a single external platform.

Our approach is different because we don’t build slow, rigid plans that sit untouched for months at a time. We work in short cycles, make decisions based on real data and adapt quickly when buyer behaviour shifts. That matters in automotive, because the market moves fast, stock mix changes constantly and every dealership has different pressures week to week.

An agile method means we test, measure and refine continuously. If certain models suddenly pick up in search volume, we adjust campaigns. If the dealership has too many ageing SUVs in stock, we push those first. If Google Ads costs rise in one area, we shift budget to where intent is stronger. You’re never stuck with an outdated strategy because we adapt it in real time.

Our work covers the full ecosystem that a modern dealership needs. That includes structured Google Ads campaigns that target make and model intent, Facebook and Instagram advertising that delivers fast local visibility, website improvements that increase conversions, SEO that supports long-term enquiries and CRM strategies that generate repeat business. Everything is shaped around measurable outcomes such as leads, cost per enquiry, stock turn and margin.

The result is a pipeline that belongs to you. It responds to your stock, your customers and your goals. It gives you independence and flexibility, rather than leaving you tied to one platform’s business model or rule changes.

Dealers who adopt this approach early usually see clearer data, better control of their lead flow and stronger profitability across the year.

The bottom line

Dealers aren’t walking away from AutoTrader because it stopped generating interest. They’re walking away because the relationship no longer feels balanced or commercially aligned. Mandatory buying flows, verification requirements, rising costs and limited consultation have pushed the trade to look elsewhere.

The message from dealers is clear. Visibility matters, but control matters more.

AutoTrader will remain part of the landscape, but its era of complete dominance is possibly coming to an end. Dealers finally have the tools to build systems that put them back in charge, and the ones who act now will be the ones who benefit.

Agilita Digital can help you build that system.